Introduction and Overview

- The Approach to this and all Articles is consistent with our Standard System and Procedure.

- The necessary work on the appointment of Avar as your Tax Agents has been undertaken:

- For you personally and partnerships (if applicable).

- For your Company or LLP (if applicable).

- For your Trust or Joint Venture (if applicable).

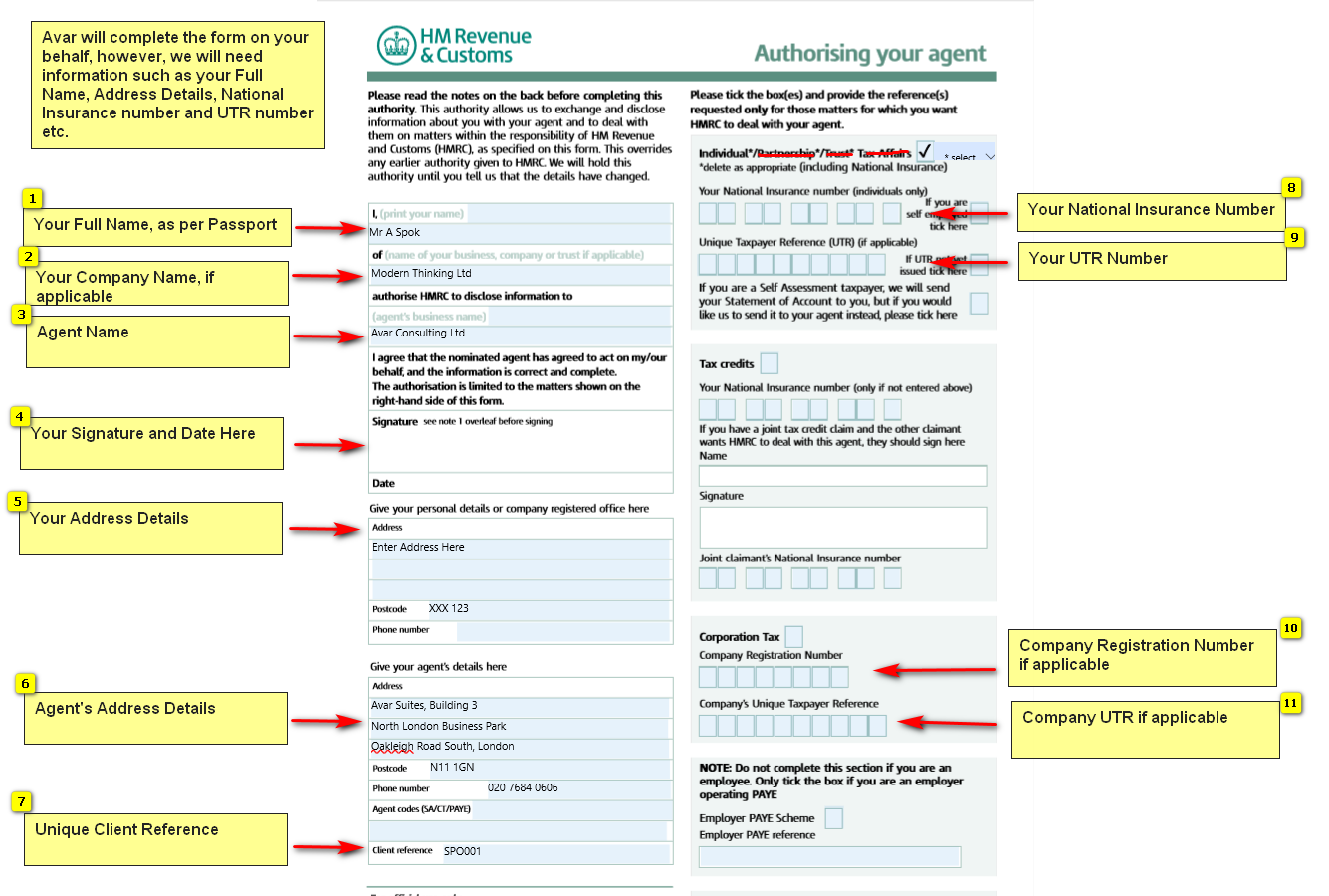

- The necessary Form(s) 64-8 will be attached separately.

- It requires your signature in the box above the date.

- Then, please post it directly to HM Revenue & Customs to the address in note 5.

- Send us a soft copy for our records.

- Request making Avar Online Agents will be submitted and a copy sent to you.

- HM Revenue & Customs will send you a code by post.

- This must be notified to Avar on receipt as it expires soon thereafter.

What is a Form 64-8?

- This is a form that you can submit to HM Revenue & Customs.

- It gives HM Revenue & Customs authority to discuss your tax affairs and deal with your accountant or tax agent directly.

- HM Revenue & Customs cannot discuss any matter without this form and is therefore very important.

- This authorisation does not transfer any responsibility to the agent, all responsibility remains with the tax payer.

What is HMRC Authorised to do?

- HM Revenue & Customs may speak to your advisers on:

- Individual Tax Affairs.

- Trust Tax.

- Partnership Tax Affairs (Each individual will need to sign a separate form 64-8).

- Pay As You Earn.

- Construction Industry Scheme (CIS).

- Corporation Tax.

- If more than one agent is acting for you, a separate form 64-8 is required for each agent.

- The services that each agent will be dealing with should be made clear on the form.

- Your agent will be able to receive your Self-Assessment statement if you have requested this.

Example of the Form

Useful Links